Closing Costs & Implications

How much does it actually cost to buy or sell a home?

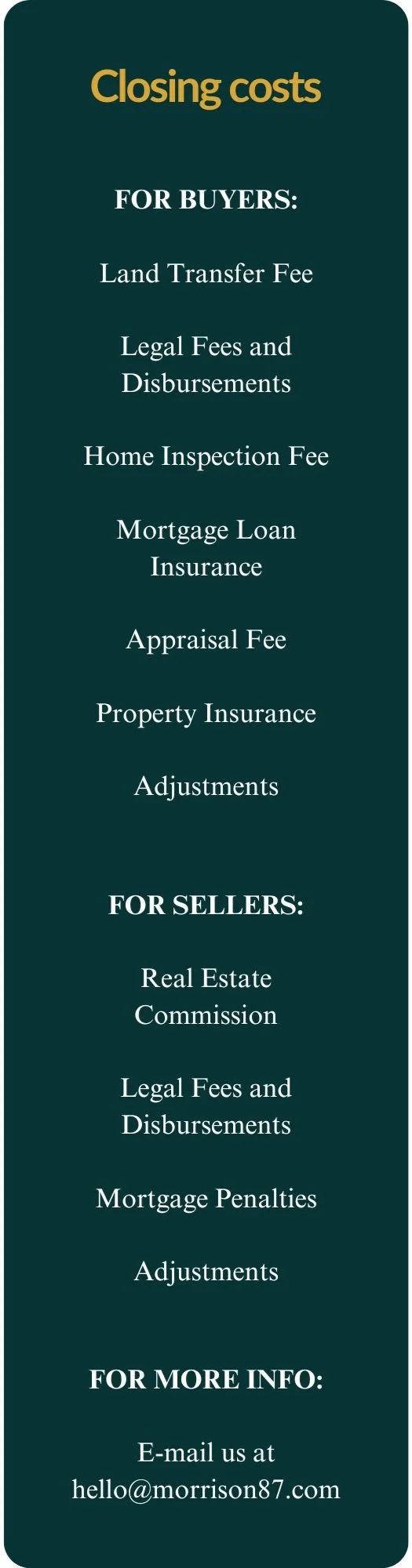

Several closing costs come into play when buying or selling real property in Saskatchewan. These costs have different implications for the overall transaction, whether you are the buyer or the seller. Understanding these costs is crucial for a smooth real estate transaction.

FOR BUYERS:

Land Transfer Fee: In Saskatchewan, buyers must pay a land transfer Fee based on the property's value. For properties valued over $8,400, the fee is 0.3% of the value. This significant cost adds to the overall expense of purchasing the property.

Legal Fees and Disbursements: Hiring a lawyer to handle the legal aspects of the transaction is necessary. These fees include the lawyer's services and other miscellaneous costs (disbursements) related to the transaction, such as document preparation and registration.

Home Inspection Fee: Before finalizing the purchase, inspecting the property is wise. It's like providing you with a report card and a cheat sheet for the property. Inspectors will determine the state of the property and its systems and give some expert information on areas of improvement. A house needs constant maintenance regardless of its age, so inspectors often include tips on what to check and when. Expect to pay between $300-$600.

Mortgage Loan Insurance: If your down payment is less than 20% of the purchase price, you'll need mortgage loan insurance. This insurance protects the lender in case of default but adds to your borrowing costs.

Appraisal Fee: Your lender may require a property appraisal to confirm its market value. This fee is often a part of securing a mortgage.

Property Insurance: Property insurance covering the home and its contents is required by the lawyer before a purchaser can take possession of the property.

Adjustments: Adjustments are made for costs prepaid by the seller, like property taxes, interest or utility bills, prorated to the closing date.

FOR SELLERS:

Real Estate Commission: This is paid to the real estate agents involved in the sale. It can be a percentage of the sale price, a fixed rate or a mixture of both.

Legal Fees and Disbursements: Similar to buyers, sellers also incur legal fees for a lawyer to handle the transaction.

Mortgage Penalties: If you're ending your mortgage term early, you might face penalties from your lender.

Adjustments: Sellers may receive credit for prepaid costs, like property taxes, prorated to the buyer from the closing date. The seller may also receive interest if funds are not in the seller's lawyer's trust account by a specific date.

Financial Planning: Understanding these costs helps in financial planning and budgeting for both buyers and sellers.

High closing costs can impact the overall viability of a transaction, especially for buyers with limited budgets.

Knowing closing costs can be used in price negotiations, as buyers might ask sellers to cover some of these expenses. In summary, closing costs in Saskatchewan vary depending on whether you are buying or selling and impact the overall financial aspect of the transaction. Budgeting for these costs in advance is essential to ensure a smooth property transfer process.